Lithium Supply and Demand

August 15, 2018

Environmental considerations and technological developments have propelled the energy storage industry, resulting in smaller carbon footprints, lower battery costs and increased Electric Vehicle (EV) car mileage. These developments have steered the industry towards newer lithium-ion batteries, and away from Internal Combustion Engine (ICE) vehicles and classical rechargeable batteries like lead acid.

Manufactures from different sectors, especially from the automotive industry, are increasingly staying away from Nickel-Cadmium (NiCad) rechargeable batteries and opting instead for the more cost effective and environmentally friendly results offered by lithium batteries.

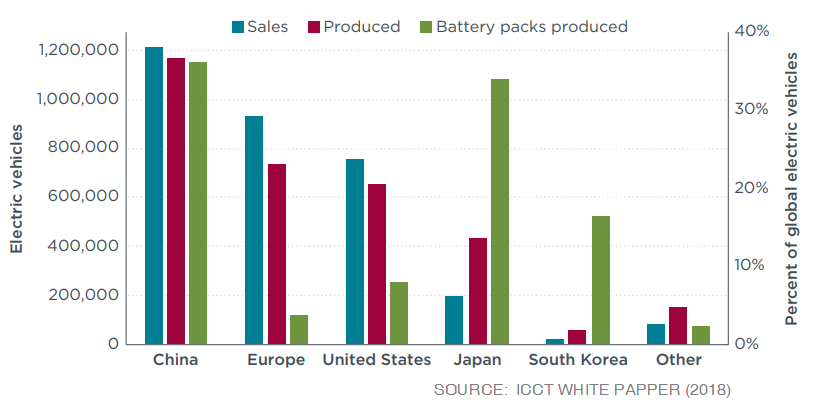

Electric car sales are forecast to be 24.4 million yearly by 2030. To give this statement more perspective, this means that electric car production is expected to spike 30 fold in the next 12 years. This brings two important questions to the forefront:

- Does the earth have enough lithium to meet this overwhelming demand?

- Is the U.S. in a position to produce lithium in sufficient quantities to meet the projected needs of domestic vehicle manufacturers?

In 2016, Chile was the world’s largest lithium producer at 37%, followed by Australia at 34%.

Projecting out to 2025, with only 30% of current lithium mining projects coming to term, Australia will supply 45%, Chile, 15%, Argentina, 15%, China, 10%, and a meager 15% by the rest of the world.

The United States Needs to Produce More Lithium

Once the world’s largest lithium industry, the U.S. declined in the 1990’s. But miners are working in North Carolina, Nevada, and half a dozen other states to revive U.S. production.

Where will the U.S. be in this new world? The U.S. currently imports about 70% of the lithium it needs. That requirement will grow exponentially in the coming years. The bad news is that it is currently not in a position to produce lithium in sufficient quantities to meet the needs of projected domestic vehicle manufacturers?

Major producers are already attempting to consolidate lithium supply. Unless the U.S. mines and processes greater lithium resources, it runs the risk of strangulation similar to that experienced at the hands of the oil cartel in the 70’s. But there is only one working mine in the U.S, the Clayton Valley Silver Peak in Nevada owned by Albemarle.

It is Time for More Lithium-Ion Recycling

If the EV industry wants to overtake the internal combustion engine (ICE), it will need to manage material prices by curbing supply imbalances. Advancement in battery recycling technology may be the answer.

If lithium-ion batteries were recycled, 95 percent of components can be turned into new batteries or used in other industries.

Today, less than 5% of spent lithium-ion batteries are recycled and there are only a handful of companies that have the technology and capacity to recycle cathode materials from lithium-ion batteries. The issue of capacity is one of the major challenges to battery recycling becoming a viable source for future EV battery materials, but one that can be addressed.

The lithium-ion battery recycling industry is in its infancy, and still has much to prove that it can be done economically.

In Conclusion

The U.S. Geological Survey produced a reserves estimate of lithium in early 2015, concluding that the world has enough known reserves for about 365 years of current global production of about 37,000 tons per year. Even though 365 years of reserve sounds comforting, if the EV projected forecast is accurate, demand will shoot up, way up. And if that happens, the supply would be substantially less.

Accurate estimates of the world lithium reserves is difficult and speculative. The future only knows.