Nine Consecutive Quarters of Record Manufacturing Optimism

March 22, 2019

“Manufacturing in the United States is on the rise, and manufacturers are confident about the future. Empowered by tax reform and regulatory certainty, manufacturers are investing in our communities and in our people. But to keep up this momentum, we have to get serious about infrastructure investment and attracting, recruiting and training our people for the high-tech, high-paying modern manufacturing jobs of today and tomorrow. As laid out in the NAM’s ‘Building to Win’ blueprint, a bold infrastructure plan will help secure American prosperity, job creation and our leadership in the world.” –NAM President and CEO Jay Timmons

The National Association of Manufacturers posted their 2019 first quarter outlook survey results, see below. The survey shows that this is the ninth consecutive quarters of record optimism, with an average of 91.8 percent of manufacturers positive about their own company’s outlook over that time frame, compared to an average of 68.6 percent across the two years of 2015 and 2016. Manufacturers’ top concern remains the inability to attract and retain a quality workforce, and concerns about our nation’s crumbling infrastructure continue to rise.

Survey Responses

1. How would you characterize the business outlook for your firm right now?

a. Very positive – 29.3%

b. Somewhat positive – 60.2%

c. Somewhat negative – 9.9%

d. Very negative – 0.6%

Percentage that is either somewhat or very positive in their outlook = 89.5%

2. Over the next year, what do you expect to happen with your company’s overall sales?

a. Increase more than 10 percent – 16.9%

b. Increase 5 to 10 percent – 29.7%

c. Increase up to 5 percent – 30.8%

d. Stay about the same – 17.1%

e. Decrease up to 5 percent – 3.6%

f. Decrease 5 to 10 percent – 0.9%

g. Decrease more than 10 percent – 1.1%

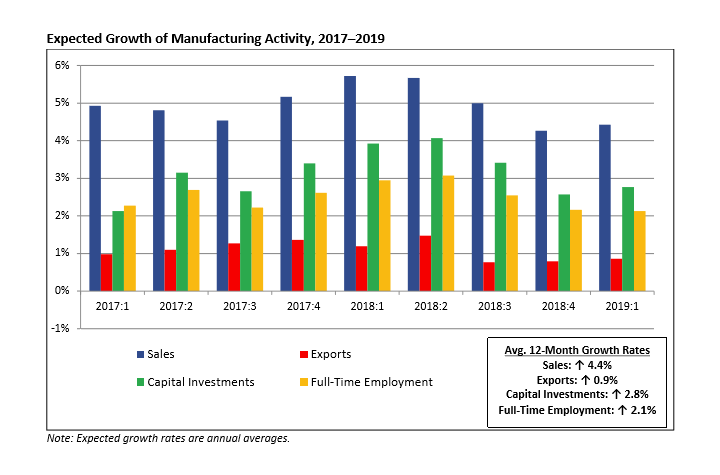

Average expected increase in sales consistent with these responses = 4.4%

3. Over the next year, what do you expect to happen with your company’s overall production levels?

a. Increase more than 10 percent – 16.7%

b. Increase 5 to 10 percent – 30.0%

c. Increase up to 5 percent – 29.8%

d. Stay about the same – 18.2%

e. Decrease up to 5 percent – 3.0%

f. Decrease 5 to 10 percent – 1.5%

g. Decrease more than 10 percent – 0.9%

Average expected increase in production consistent with these responses = 4.4%

4. Over the next year, what do you expect to happen with the level of exports from your company?

a. Increase more than 5 percent – 12.7%

b. Increase 3 to 5 percent – 8.4%

c. Increase up to 3 percent – 10.4%

d. Stay about the same – 61.1%

e. Decrease up to 3 percent – 2.4%

f. Decrease 3 to 5 percent – 1.7%

g. Decrease more than 5 percent – 3.2%

Average expected increase in exports consistent with these responses = 0.9%

5. Over the next year, what do you expect to happen with prices on your company’s overall product line?

a. Increase more than 10 percent – 2.4%

b. Increase 5 to 10 percent – 13.8%

c. Increase up to 5 percent – 49.7%

d. Stay about the same – 30.1%

e. Decrease up to 5 percent – 3.7%

f. Decrease 5 to 10 percent – 0.2%

g. Decrease more than 10 percent – 0.2%

Average expected increase in product prices consistent with these responses = 2.4%

6. Over the next year, what do you expect to happen with raw material prices and other input costs?

a. Increase more than 10 percent – 4.9%

b. Increase 5 to 10 percent – 21.5%

c. Increase up to 5 percent – 50.9%

d. Stay about the same – 18.7%

e. Decrease up to 5 percent – 3.7%

f. Decrease 5 to 10 percent – 0.4%

g. Decrease more than 10 percent – none

Average expected increase in raw material prices consistent with these responses = 3.3%

7. Over the next year, what are your company’s capital investment plans?

a. Increase more than 10 percent – 15.4%

b. Increase 5 to 10 percent – 17.7%

c. Increase up to 5 percent – 19.4%

d. Stay about the same – 38.5%

e. Decrease up to 5 percent – 3.6%

f. Decrease 5 to 10 percent – 1.5%

g. Decrease more than 10 percent – 3.9%

Average expected increase in capital investments consistent with these responses = 2.8%

8. Over the next year, what are your inventory plans?

a. Increase more than 10 percent – 3.6%

b. Increase 5 to 10 percent – 6.0%

c. Increase up to 5 percent – 19.9%

d. Stay about the same – 48.6%

e. Decrease up to 5 percent – 14.8%

f. Decrease 5 to 10 percent – 4.7%

g. Decrease more than 10 percent – 2.4%

Average expected increase in inventories consistent with these responses = 0.4%

9. Over the next year, what do you expect in terms of full-time employment in your company?

a. Increase more than 10 percent – 4.5%

b. Increase 5 to 10 percent – 14.5%

c. Increase up to 5 percent – 34.8%

d. Stay about the same – 40.0%

e. Decrease up to 5 percent – 4.1%

f. Decrease 5 to 10 percent – 1.3%

g. Decrease more than 10 percent – 0.9%

Average expected increase in full-time employment consistent with these responses = 2.1%

10. Over the next year, what do you expect to happen to employee wages (excluding non-wage compensation, such as benefits) in your company?

a. Increase more than 5 percent – 4.3%

b. Increase 3 to 5 percent – 30.1%

c. Increase up to 3 percent – 58.1%

d. Stay about the same – 7.3%

e. Decrease up to 3 percent – none

f. Decrease 3 to 5 percent – none g. Decrease more than 5 percent – 0.2%

Average expected increase in employee wages consistent with these responses = 2.3%

11. Over the next year, what do you expect to happen to health insurance costs for your company?

a. Increase 15.0 percent or more – 6.6%

b. Increase 10.0 to 14.9 percent – 16.2%

c. Increase 5.0 to 9.9 percent – 43.2%

d. Increase less than 5.0 percent – 21.2%

e. No change – 8.1%

f. Decrease less than 5.0 percent – 0.9%

g. Decrease 5.0 percent or more – 0.6%

h. Uncertain – 3.2%

Average expected increase in health insurance costs consistent with these responses = 6.7%

12. What are the biggest challenges you are facing right now? (Check all that apply.)

a. Weaker domestic economy and sales for our products to U.S. customers – 24.1%

b. Weaker global growth and slower export sales – 18.5%

c. Trade uncertainties (e.g., actual or proposed tariffs, trade negotiation uncertainty) – 52.6%

d. Strengthened U.S. dollar relative to other currencies – 19.6%

e. Challenges with access to capital or other forms of financing – 5.0%

f. Unfavorable business climate (e.g., taxes, regulations) – 24.1%

g. Increased raw material costs – 55.8%

h. Rising health care/insurance costs – 56.5%

i. Transportation and logistics costs – 34.3%

j. Attracting and retaining a quality workforce – 71.3%

13. What is your company’s primary industrial classification?

a. Chemicals – 5.6%

b. Computer and electronic products – 2.1%

c. Electrical equipment and appliances – 6.9%

d. Fabricated metal products – 32.1%

e. Food manufacturing – 1.7%

f. Furniture and related products – 2.1%

g. Machinery – 12.0%

h. Nonmetallic mineral products – 3.0%

i. Paper and paper products – 1.1%

j. Petroleum and coal products – 0.6%

k. Plastics and rubber products – 6.9%

l. Primary metals – 2.4%

m. Transportation equipment – 3.6%

n. Wood products – 2.8%

o. Other – 17.1%

14. What is your firm size (e.g., the parent company, not your establishment)?

a. Fewer than 50 employees – 22.3%

b. 50 to 499 employees – 49.4%

c. 500 or more employees – 28.3%

SPECIAL QUESTIONS

15. How important is it for your company to have the new United States–Mexico–Canada (USMCA) Trade Agreement approved?

a. Very important – 33.8%

b. Somewhat important – 41.7%

c. Not important – 20.2%

d. Uncertain – 4.3%

16. Has trade uncertainty negatively impacted your company’s business plans and outlook?

a. Yes – 48.2%

b. No – 36.6%

c. Uncertain – 15.3%

17. Do you believe the current state of our nation’s infrastructure is positioned to respond to the competitive demands of a growing economy over the next 10–15 years?

a. Yes – 8.0%

b. No – 77.4%

c. Uncertain – 14.7%

18. Would passage of a major infrastructure bill positively impact your company’s business plans and outlook?

a. Yes – 56.1%

b. No – 20.7%

c. Uncertain – 23.2%

19. Is our current immigration system meeting the needs of employers and businesses in the United States?

a. Yes – 15.7%

b. No – 66.9%

c. Uncertain – 17.4%

20. Have executive orders and administration actions on immigration negatively impacted your company’s business plans and outlook?

a. Yes – 17.3%

b. No – 69.1%

c. Uncertain – 13.6%

21. Please estimate on a scale of 0 (no change) to 100 (complete certainty) the probability of a recession in the United States in the next 12 months.

Average of responses of the probability of a recession in the U.S. in the next 12 months = 35 percent

22. If Congress rolled back business provisions of the Tax Cuts and Jobs Act (e.g., by increasing the corporate tax rate, limiting the new deduction for pass-through business income or reducing incentives for capital equipment purchases), would your business consider reducing capital investments in the United States?

a. Yes – 66.2%

b. No – 33.8%

23. If Congress rolled back business provisions of the Tax Cuts and Jobs Act, would your business consider scaling back employment in the United States?

a. Yes – 54.4%

b. No – 45.6%

24. If Congress rolled back business provisions of the Tax Cuts and Jobs Act, would your business consider scaling back wage and bonus increases in the United States?

a. Yes – 61.9%

b. No – 38.1%